WHITE PAPER:

Competitive Advantages of Collaring a Spot Trade

This paper compares the revenue generated by (and profit/loss profiles of) a typical spot trade versus the revenue generated by the same spot trade combined with a popular option strategy that traders often implement around spot positions.

Click here to read the document.

WHITE PAPER:

Credit, Margin & Risk Management

FX Bridge’s credit, margin and risk management facility is designed to support dealing operations that have lines of credit and/or margin relationships with their customers. It is a multi-layered integrated system designed to give account and risk managers a real-time, 360-degree view of client account market risk across time and price.

Click here to read the document.

WHITE PAPER:

Option Strategies for Spot Traders

Although options are complex financial instruments, traders who are new to options can still use them for very simple, yet effective strategies in conjunction with their spot trading. In this paper we examine four strategies for spot trader to either enhance or protect spot trades.

Click here to read the document.

WHITE PAPER:

Gaining Leverage with Options

This paper explains with a series of examples how options trading can increase the leverage over a spot trade. This ability becomes especially attractive in areas where spot leverage has been significantly reduced.

Click here to read the document.

WHITE PAPER:

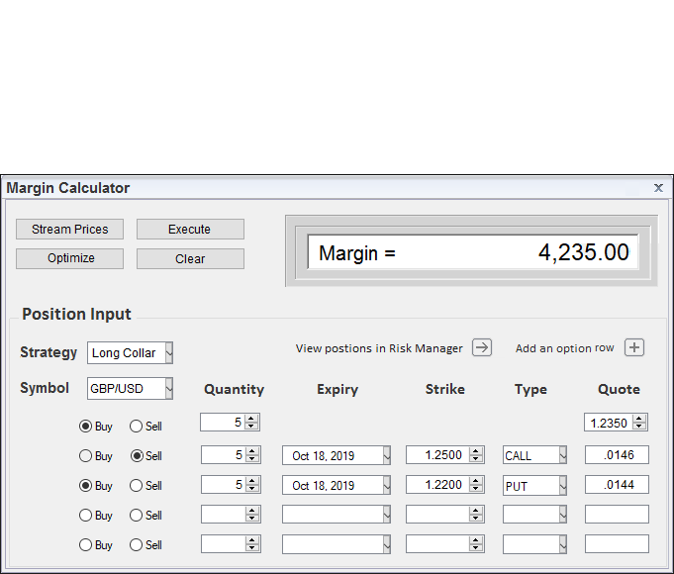

Security Deposits for U.S. Forex Options

This paper describes the advantages risk-based portfolio margining offers over the current NFA Forex regulatory guide for Forex Dealing Merchants treatment of customer security deposits.

Click here to read the document.

WHITE PAPER:

Understanding Options

Option contracts on currencies offer many investment and risk management strategies, including a wide and diverse range of potentially attractive trading opportunities. A trader knowledgeable in the use of options can define virtually any risk/reward profile and implement strategies appropriate for almost any market condition. This paper is designed to provide a basic understanding of options on currencies — what they are, how they work and the opportunities and risks involved in trading them.

Click here to read the document.