Client Advantage: A Simple-to-Use, Turnkey Dealing Solution.

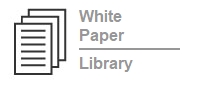

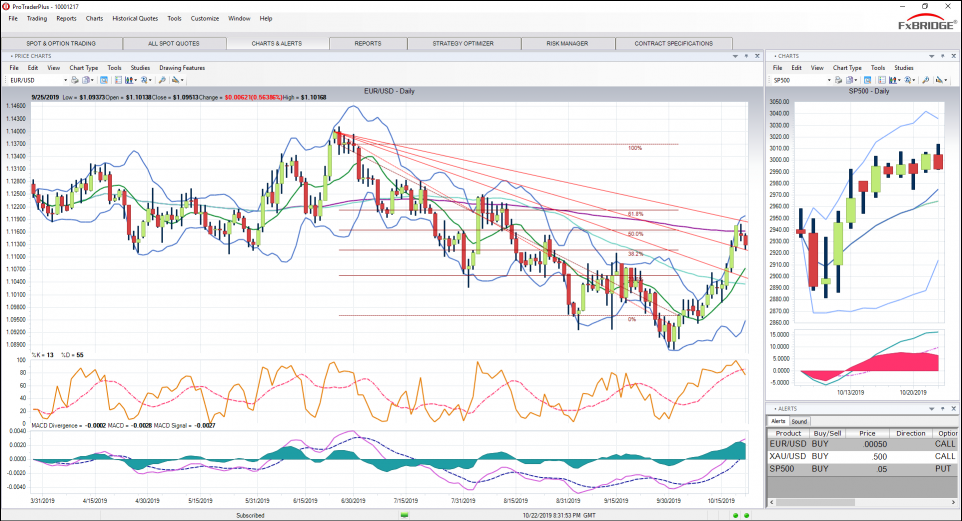

Everything you want in a feature-rich trading platform

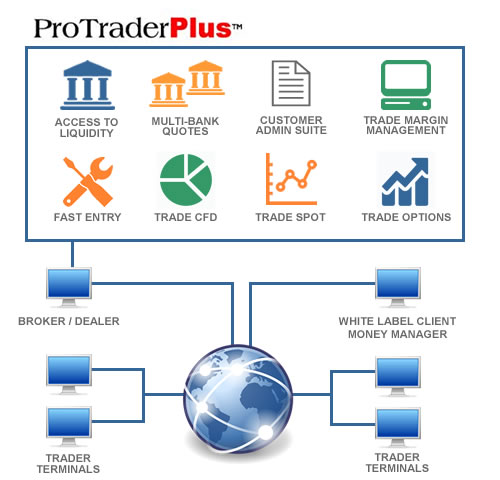

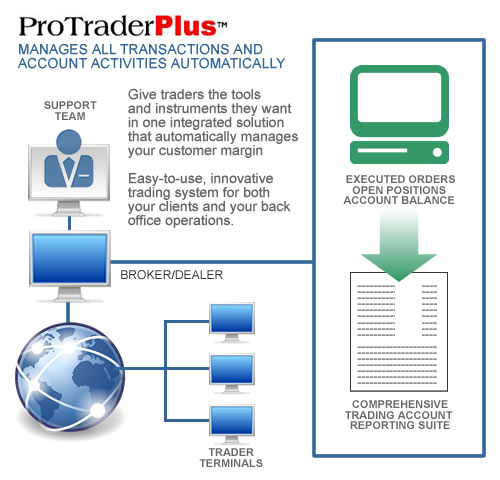

Rapid and simple implementation with Industry-leading support

Instant advantage over spot-only competitors

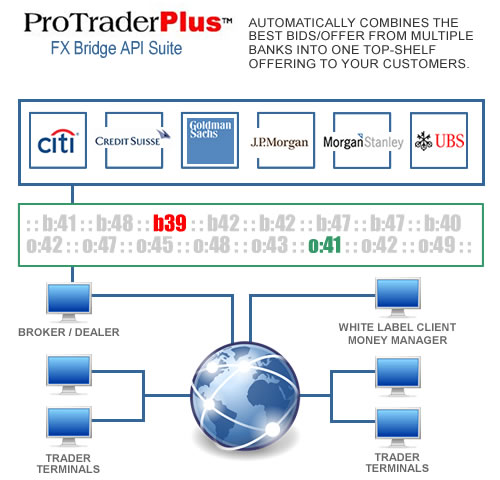

Turnkey implementation with access to multiple liquidity providers

Proven experience in managing FX options platforms

Completely customizable, feature-rich trade station with the easy to use, intuitive interface your customers want.

Extensive reporting with tradable charting, analytics and algorithmics

Real-time option quote screens consistent with stock and futures Forex Options trading.

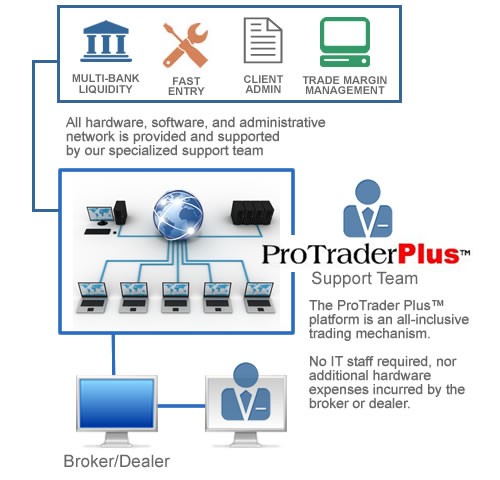

Comprehensive front-to-back office management system

Customer-centric, product-centric, and regulatory reporting

Easy-to-read information format with embedded drill-down functionality for accessing hierarchically-organized data.

Full derivative pricing, margining, risk management, and analysis tools suite available to all users from the dealer to the trader.

Proprietary volatility skew modeler/surface interpolator – simultaneously prices and quotes thousands of Forex Options automatically.

SPAN-type volatility-based margining system for multi-instrument portfolios.

Multiple built-in user interfaces specifically designed for liquidity providers, white-label partners, introducing brokers, managed account traders, and retail and institutional trading customers.

Unlimited-depth hierarchical white-labeling network