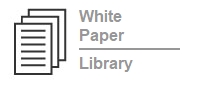

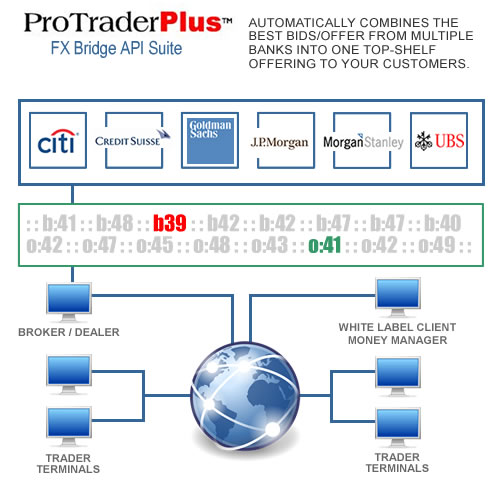

The only true multi-bank Options liquidity platform

Any platform can connect to a few banks and call themselves multi-bank. It’s nothing more a telephone desk asking for different prices and it simply does not work. FX Bridge’s ground-breaking technology automatically combines the best prices from the banks into a single “top-shelf” offering for your clients.

What ProTrader Plus™ displays is the best of the best.

Any platform can connect to a few banks and call themselves multi-bank. It’s nothing more a telephone desk asking for different prices and it simply does not work. FX Bridge’s ground-breaking technology automatically combines the best prices from the banks into a single “top-shelf” offering for your clients.

What ProTrader Plus™ displays is the best of the best.

You deserve the peace of mind of knowing that ProTrader Plus™ has done all the work to deliver your clients the best prices – objectively and automatically.

Access to Liquidity Without Connecting to Major Banks

Banks want and compete for your retail trade flow and traders want the strategies and risk management that only Options offers.

“Having access to FX Options along with traditional spot FX symbols from one margin account within the same trading platform will give our clients greater flexibility to manage their trading strategies and risk exposure. FX Bridge offers extremely innovative solutions for both our clients and our back office operations…”

Daniel Skowronski, CEO, Alpari (US)

The companies listed below are offering ProTrader Plus 6.0 demonstrations. We encourage you you visit them for a test drive.

Fast, Easy Implementation

Painless roll-out with a tech support team at your side

ProTrader Plus™ support team trains your dealing and administrative staff into becoming expert users of the platform. We’re on-call 24 hours a day, 6 days a week to assist your staff in every aspect of supporting your platform.

The ProTrader Plus™ platform is an all-inclusive trading mechanism. All hosting hardware, software, and administrative network is provided and supported by our specialized support team. No IT staff required, nor additional computing expenses incurred by the broker or dealer.

FX Bridge® also provides OptionsEDU™, a multi-level Options education suite to enrich customers new to FX Options.

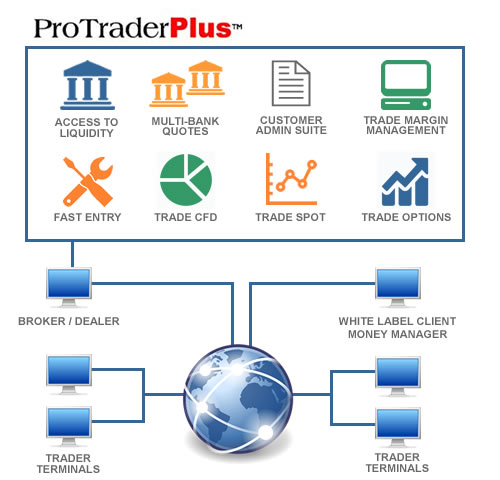

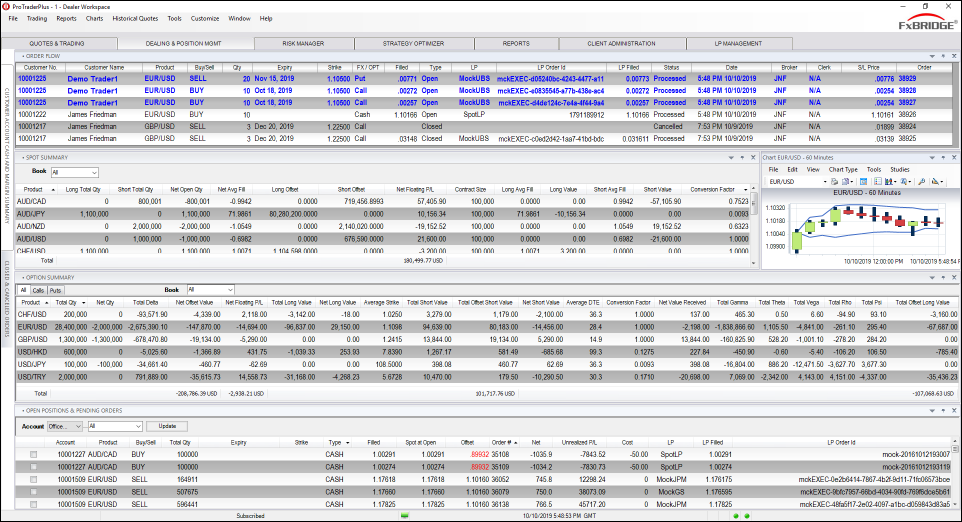

Built-in Customer Administration

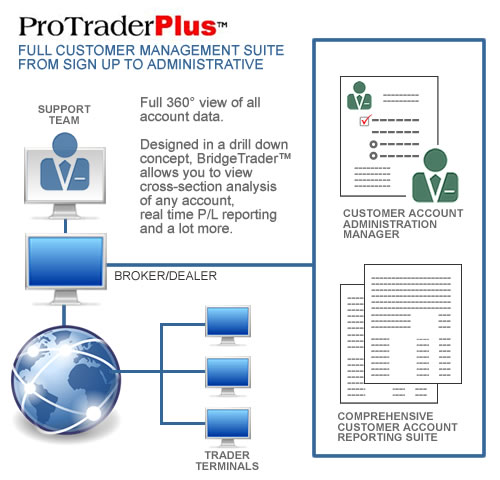

Custom trader margin

Customize each trader’s margin warning and cut-loss points to ensure they don’t over leverage their account. Before they become negative, the platform is continuously scanning and reducing exposure as you see fit. The platform will automatically remove all customer exposure, or systematically remove each position following your rules. Your margin management profiling can be the default for all traders, for select groups, or customized for each and every trader.

Customize commissions, fees and rebates.

You define whether accounts are charge fees and commissions, or widened spreads, or both. Each organization can be tailored to fit their individual business needs or follow your company standards.

Full view reporting and accounting.

Comprehensive Reporting & Account Management Application

Drill Down Reporting Concept

Cross Section View Analysis

Data Mining & Intelligence Gathering Tools

Open Positions versus Open Position Summary

FCM Management versus IB Management

IB Management versus Account Management

Regulatory, Management & P/L Reporting

The 360° view of all account data is designed in a drill down concept, BridgeTrader™ allows you to view cross-section analysis of any account, real time P/L reporting and more.

Your Choice of Expiries and Tenors

Our platform allows you to configure three types of option expirations:

1. Fixed dates:

These are option expirations that occur either on a specific date in the month or on a day of the week. For example, options can be set to expire on the third Thursday of each month (much like exchange-style equity or futures option expirations) or they can be fixed to expire on the same day of the week, like offering Friday expiry options.

2. Standard tenors:

These are option expirations based on standardized timeframes; they are set to expire according to a given amount of time (days, weeks, months) from the present. Examples would be 1 week, 2 week, 1 month, or 3 month option expirations, or overnight options.

3. Custom dates:

They are also called “broken date options,” or what you referred to as “odd dates.” These are option expirations that can be set to expire on any future date (a business day) and are selected by the end-trader based on conditions (size, time, etc.) set by dealer.

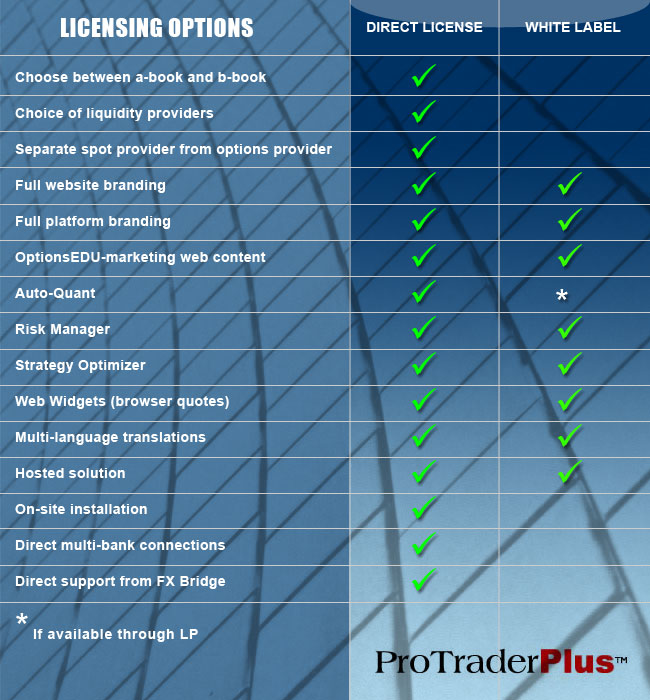

More Products, More Business, One Solution

Full customer margin management for combined spot and options trading

Give traders the tools and instruments they want in one integrated solution that automatically manages your customer margin. Learn how ProTrader Plus™, the only trading platform offering true multi-bank liquidity, can help your business. Trial version available.

Make Your Market

Opportunities for Market-Makers

ProTrader Plus™ is also a complete options dealing environment for the broker-dealer looking to make a market. The real-time valuation and greeks displays provide a robust risk-management facility of the client portfolio. Broker-Dealers can then provide liquidity to white-label Introducing Brokers and Marketers, manage pip rebates, commissions, etc for smaller Forex firms unable to establish sufficient Prime Broker resources.

Exclusive Option Pricing & Modeling

Real-time revaluation of portfolio – See the impact on your portfolio before effecting changes. Reduces risk by showing you exactly where you are positioned before and after making price changes.

Simplified option modeler – Set the option volatility skew for hundreds of options with just a couple changes in parameters.

Easy modeling of market prices – Simple entry of market prices or volatilities for options automatically models the volatility skew for you

Flexible spread management – By having total control over spreads to IBs, and to traders, dealers can offer IB commissions or pip-rebates or both.

LET’S GET STARTED

Schedule a PresentationOnly ProTrader Plus™ combines and delivers the world’s largest financial institutions to the retail options trader. Our mission is to provide our customers with the best technologies and services available in the industry. |

|

Test Drive for 30 DaysExperience a fully operational trial version of ProTrader Plus in a real-time environment and familiarize yourself with no obligation. You will receive $50,000 virtual margin credits and access to a version of ProTrader Plus for 30 days. |

|

ProTrader Plus™FX Bridge Technologies is a leading global provider of the most comprehensive trading instruments available today. Speak with an FX Bridge representative and learn how ProTrader Plus™ can help your business. |