FX Bridge Institutional Services

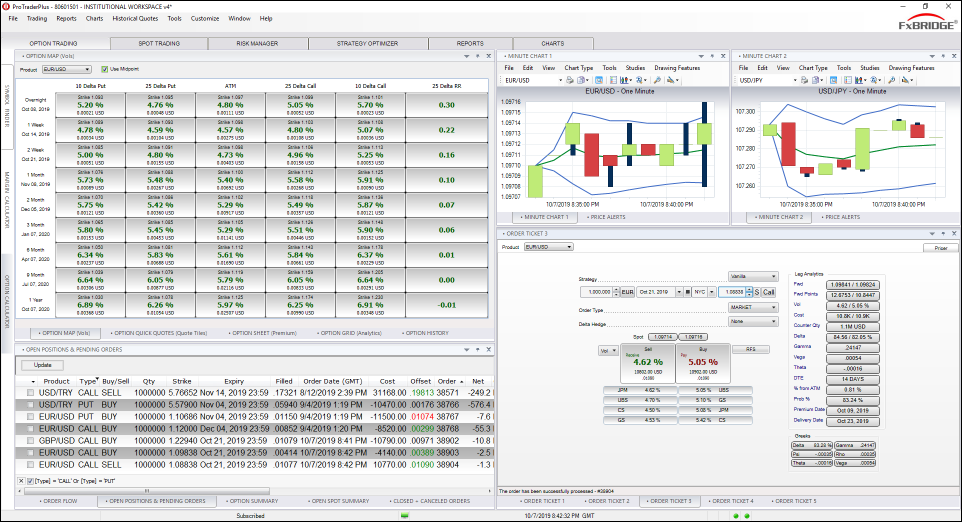

FX Bridge Institutional Services’ BridgeXcess platform provides proven, transaction-oriented technology to the institutional marketplace. Hedge Funds, Corporate Treasurers, and Institutional investors have specific pre-trade, trade, and post-trade requirements. BridgeXcess provides banks and swap execution facilities with Single dealer and SEF technology that allows them to deliver compliant, state-of-the-art products and services to their FX option trading customers.

Highlights

BridgeXcess provides banks and brokers with a Dodd-Frank compliant, single dealer platform

Central clearing of FX Options poses issues that may delay mandatory clearing. BridgeXcess gives banks and dealers the flexibility to adapt to a constantly changing regulatory environment

BridgeXcess delivers the best in multi-bank liquidity aggregation and smart routing with built-in SEF migration and hybrid functionality

BridgeXcess covers every facet of applicable Dodd/Frank, MiFID II, and EMIR regulation:

Margin

Trade execution

Reporting

Clearing

Record keeping

BridgeXcess Features

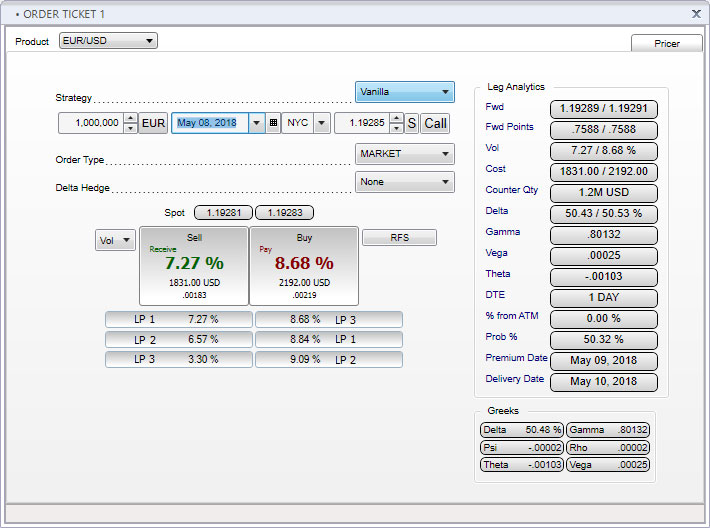

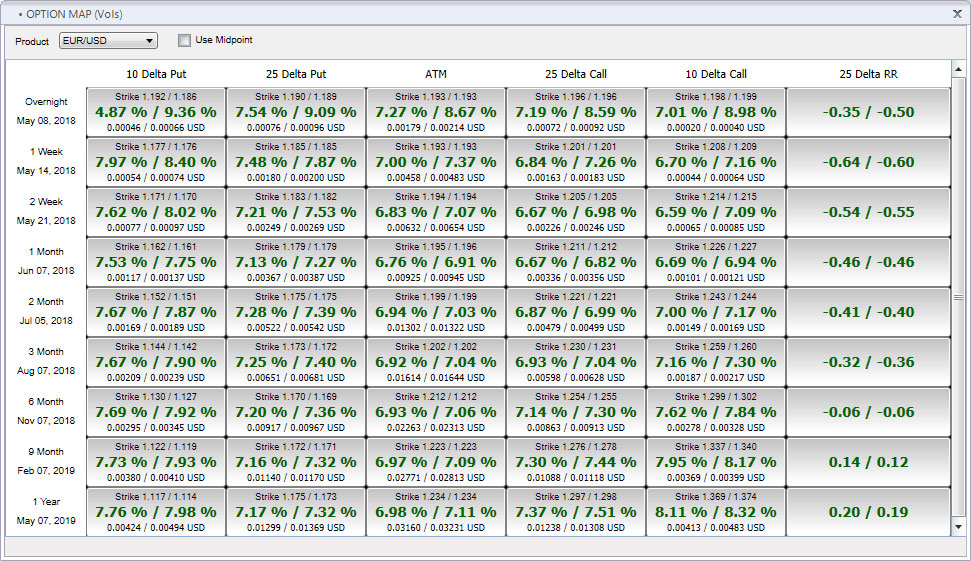

Execution

Request for Stream for “on-the-run” and “off-the-run options

Liquidity from top tier banks

Depth of book and VWAP views

Auto-quoting via pricing engines

Volatility and price views

Credit Monitoring

Best practices credit management

Real-time revaluation

Immediate trader and dealer notification for any breaches in thresholds

Customized credit / margin rules

Reporting

SDR Extracts for both transactions and daily mark-to-market

Portfolio reconciliation\

Trade compression

Clearing

Back-office drop-copy / post-trade API architecture

Integrated Prime Broker clearing API

Integrated central clearing API

Direct to Prime Broker or Traiana Harmony certified connectivity

Record Keeping

Fully compliant data warehousing

Certified and secure datacenter

Approved process in place for standards review

Approved business continuity and disaster recovery plan

Middle / Back Office

Built-in customer setup and management or simplified integration to existing backoffice

Real time customer position reporting

Real time product position reporting

Real time credit line utilization monitoring