BridgeTrader™ Products

The Reporting System

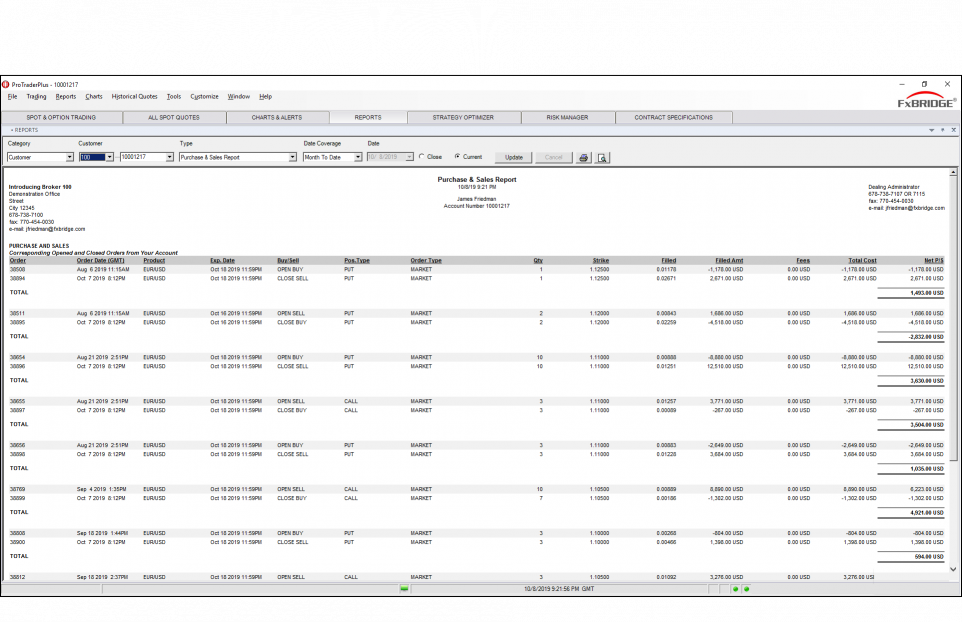

The Reports provide 24-hour instant access to our BridgeTrader™ comprehensive reporting server system.

Access current reports for any period

Access archived reports from account inception

Data exports in multiple popular formats

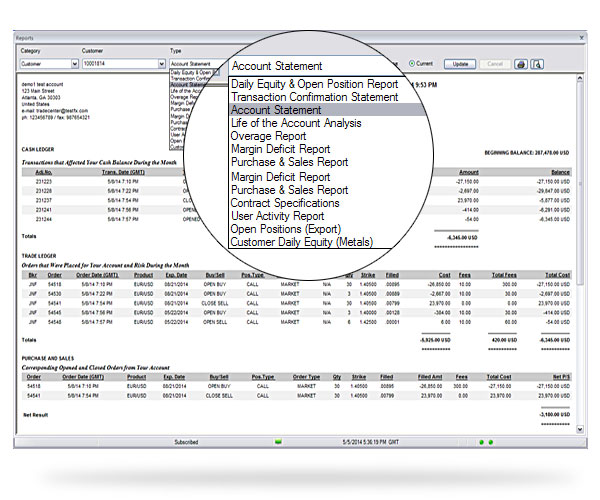

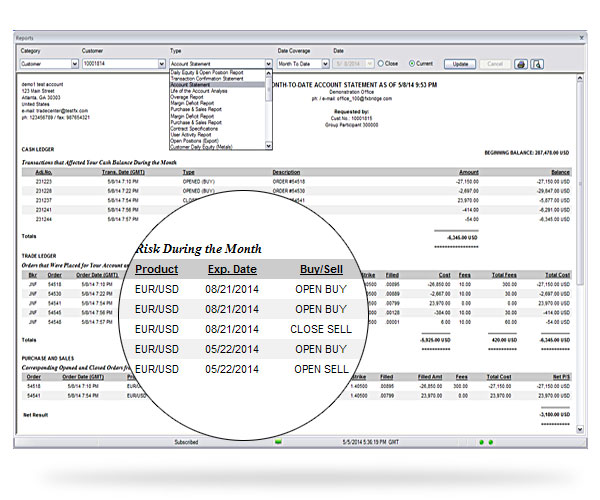

View open and pending positions, profit and loss, transaction confirmations, account statements, and cash ledger balances on-demand 24 hours a day

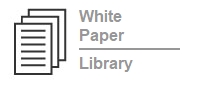

Extensive reports: Daily Equity & Open Position Report, Transaction Confirmation Statements, Account Statements, Life of the Account Analysis, Purchase & Sale Report, Margin Report, Credit Report, User Activity report, Contract Specifications Table

Bridge Trader (BT) Connectivity

Only FX Bridge’s Bridge Trader (BT) Connectivity allows transaction flows to so many diverse environments. BT Connectivity provides an infrastructure and framework that extends beyond a single platform for Straight Thru Processing (STP) and Direct Market Access (DMA). Now FX Bridge clients can receive the best liquidity from private market makers and money center banks and participate in offering liquidity as well. BT Connectivity is the gateway to both make and take trade flow and now includes new management facilities to intelligently route and monitor where trades come in from and where trades are passed or kept.

FX spot trades and market data may come from virtually any FIX, XML, or proprietary feed. BT Connectivity connects seamlessly to Currenex™, CFH, Integral, LMAX Exchange, KCG Hotspot, First Derivatives and many more.

|

|

|

|

|

|

|

With BT Connectivity Enhanced Routing Facility, Dealers can combine all liquidity sources into best bid and offer pools, or define trade paths based on:

Lot size

Currency pair

Account status

Days to expiration

Trade net delta

Trade notional value

Aggregate position

and much more.

BT Connectivity immediately drop-copies all trades to the dealer’s prime broker, or any external risk book management. Connecting to many prime brokers directly and through the Traiana™ Harmony network gives dealers access to virtually any prime broker or prime of prime brokers such as LMAX Exchange, CFH Clearing and Boston Prime. FX Bridge will work with your IT staff to provide the right format and protocol that reduces your effort and speeds your time to market.

|

|

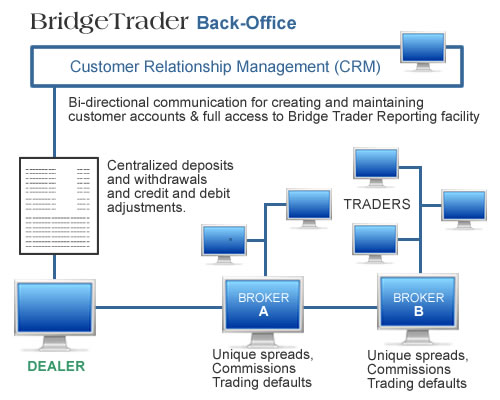

Bridge Trader Back-Office

Bridge Trader Back-Office provides all client management, risk management, and treasury management.

Client and trader accounts are profiles that the dealer can create through default settings or customize for each individual trader. Each client can have a unique set of spreads, commissions, and trading defaults, or can share settings common to other profiles. This facility minimizes the amount of work to add new accounts, make deposits and withdrawals, and credit and debit adjustments. Each trader can share in default system-wide margin management settings for early warning and cut-off points or be tailored to each individual account holders’ unique situation. Each account can be setup within a managed account group, or act independently.

In addition to a full-interactive menu environment for the back-office, Bridge Trader Back-Office provides an API to integrate directly with the dealers Customer Relationship Management (CRM) or back office platform. The API supports bi-directional communication for creating and maintaining the customer accounts. The API also includes full access to all of FX Bridge Reporting facility for XML, comma delimited and formatted HTML formats.

FX Bridge has the experience with scores of customer implementations. No other vendor offers such platform customization with so little effort from your IT department. FX Bridge is prepared to take care of it all.