Midpoint Data Solutions™

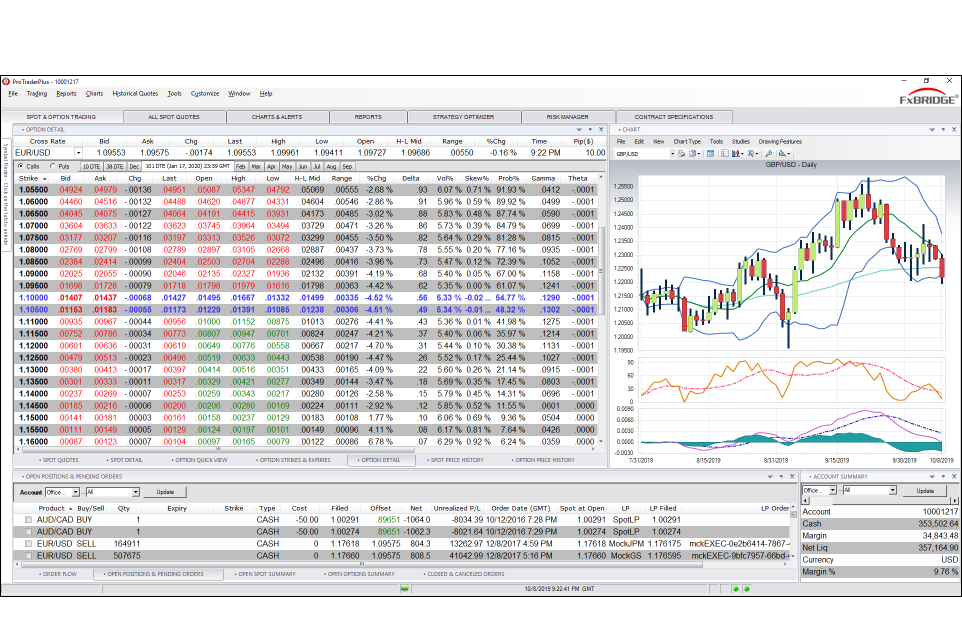

FX Bridge has the most comprehensive set of volatility values in Forex.

While other vendors stop at a center volatility surface for any 24 hour within a day, only FX Bridge normalizes the data to provide both volatility surfaces and option premium grids across 20 ITM to 40 OTM vanilla option strikes. And there’s much more. Both on the run and off the run data sets gives analysts and traders the most.

Sources Matter:

Data comes from market-makers and market-takers that range from boutique marketers to the largest banks on the globe. No other company has a wider selection. We apply our aggregation technology so you get the cleanest, most accurate data possible.

Quantity and Quality:

Our sampling rate brings tens of thousands of data points together for each currency pair; more than any other market data provider. In addition, by comparing dozens of sources, erroneous data points are virtually eliminated.

Flexibility:

You can get a single snapshot for a currency pair, end-of-day and inter-day historical prices across over 3 years depending on the pair. You can even sign-up for streaming data; you tell us what you need. You’ll have enough back-testing data points to work through any analytical model. You’ll get all the live data to compete with the big boys. All data is available in multiple formats. Consult your sales specialist to customize a solution just for you.

Volatility Index

Volatility as an indicator has been widely used in many markets. Forex has never had such an indicator. This means that traders are missing a critically important market metric that’s been available in stocks and commodities for years. The new FX Bridge Volatility Index, (FXVX) fills that gap.

The FXVX is a weighted sum of the 30-day at-the-money implied volatilities of various USD cross rates (i.e. XXX/USD or USD/XXX). The cross rates chosen are those that have a global market turnover greater than 2.5% of the total. For the BIS surveys completed in 2010 and 2013, this includes EUR, JPY, GBP, AUD, CAD, and CHF.

To learn more about the mechanics behind the FXVX and receive a copy of our FX Bridge Volatility Index white-paper, or to learn how we can help you white label or customize your own volatility index, please contact FX Bridge.